40+ How much money can i lend for a mortgage

You could get an agreement in principle that lasts 6 months sorted in a 30-minute phone call. FHA Loans Please visit our FHA Loan Calculator to get more in-depth information regarding FHA loans or to calculate estimated monthly payments on FHA loans.

Simple Loan Calculator For Excel Loan Calculator Mortgage Calculator Car Loan Calculator

If you already have a mortgage with us you can take your first direct mortgage with you when you move house known as.

. Or 4 times your joint income if youre applying for a mortgage. When mortgage rates are low as they were in much of 2020 and 2021 homeowners wanting to borrow money against that equity for big expenses took advantage of cash-out refinances in which you take. If your union provides a bank account facility itll operate very much like a Basic Bank Account.

These are usually interest-only mortgages which means you only repay the interest each month and reimburse the amount borrowed the capital at the end of the term. You need to be a first time buyer whos living and buying a home in England or Wales. FHA loans generally require lower down payments as low as 35 of the home value while other loan types can require up to 20 of the home value as a minimum down payment.

This will give you a solid idea of how much you can borrow the type of rates you have access to and whether a lender will accept. Find out what you can borrow. You need to be aged under 40 when you open it and cant access your savings or the bonus until youve had the account for at least a year.

Lenders will thoroughly evaluate your income and assets credit score and debt-to-income ratio. How long the mortgage lasts will affect your monthly payments and the total cost of the mortgage. This is where a family.

Mortgage pre-qualification is an informal estimate of how much money you can borrow for a home loan. UK Mortgage Lending Ltd UKMLL ta Pepper Money is authorised and regulated by the Financial Conduct Authority FCA under registration number 710410 as a provider of regulated. The term of a mortgage usually lasts between 25 and 35 years.

Mortgage rates climbed over 6 this week for the first time since the housing crash of 2008 threatening to sideline even more homebuyers from a rapidly cooling housing. However it will take you longer to pay off the loan so you will pay more interest. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes tied to.

With a repayment mortgage the longer the term the lower the monthly payment. Average long-term US. A 100 mortgage covers the full cost of the house meaning you dont need a deposit.

You can borrow up to maximum of 500000 for your mortgage. These are only offered by a few credit unions such as Glasgow Scotwest Capital Credit Unions all in Scotland and No 1 Copperpot Credit Union for police staff. Buy to let mortgage index.

A buy-to-let mortgage is required if you are looking to buy a property to rent out as an investment. The type of mortgage you choose can have a dramatic impact on the amount of house you can afford especially if you have limited savings. So in order to raise the full amount needed to buy the property we need to borrow money through a mortgage.

The type of mortgage you choose dictates how you repay the amount youve borrowed over the term of the mortgage. You will typically need a deposit of at least 20 to be approved and the amount you can borrow. The mortgage term is the period you choose to hold or repay the mortgage over.

Buy to let mortgages. These financial factors also influence how much they are willing to lend borrowers. The Club Lloyds 250 cashback offer can stop at any time.

Use our Residential Mortgage calculator to give you an indication of how much we could lend your clients. With the Help to Buy scheme you can access a government-backed interest-free equity loan that can boost a 5 deposit to 25 in London your 5 deposit can be boosted by as much as 40. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

Because it is so leniently enforced certain lenders can sometimes lend to risky borrowers who may not actually qualify based on the 2836 Rule. Mortgage terms - mortgage terms of up to 40 years are available. You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit.

It can be anything from 5 to 40 years depending on the lender. Overall mortgage debt tends to grow around 3 to 6 per annum though there can be significant fluctuations in that rate of growth due to factors like BREXIT the global economic crisis which happened in 2008 COVID-19 lockdowns etc. However as a drawback expect it to come with a much higher interest rate.

However never pick a mortgage without looking at the whole market. This mortgage finances the entire propertys cost which makes an appealing option. If this is the maximum conforming limit in your area.

A mortgage is an arrangement where you borrow money from a lender to buy a property whether as a home or investment such as a buy-to-let. This means that applicants need to be able to put down a deposit of 25-40 of the propertys value. Currently the only kind of 100 mortgage you can get is a guarantor mortgage.

Mortgage advisers available 7 days a week. Whats more itll take less than a minute to complete. Fee-free valuation Fee Saver mortgages available too mortgage terms up to 40 years.

For example an interest-only mortgage means you only pay back the interest. The Lend a Hand Mortgage cant be used for interest only mortgages New Build Right to Buy shared equity or shared ownership.

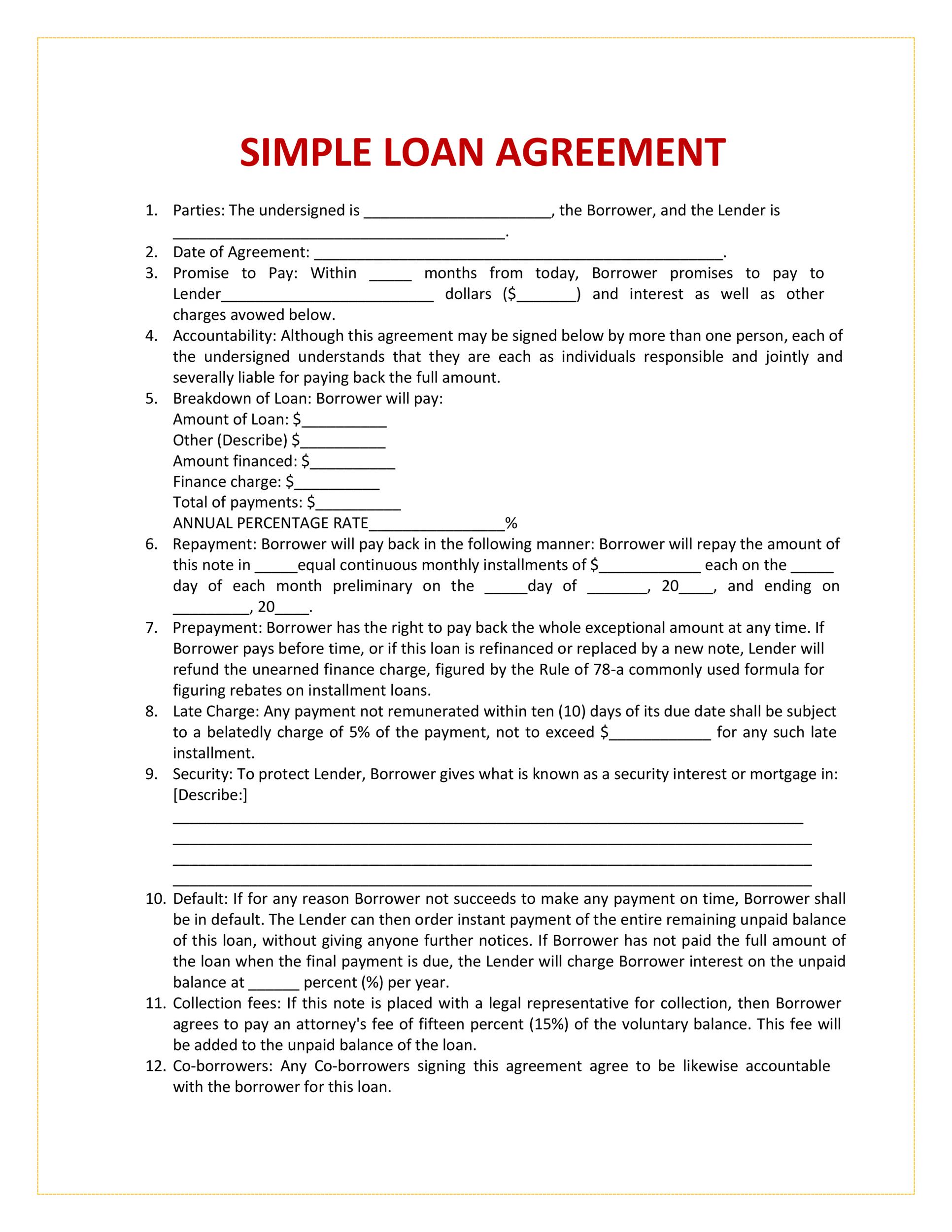

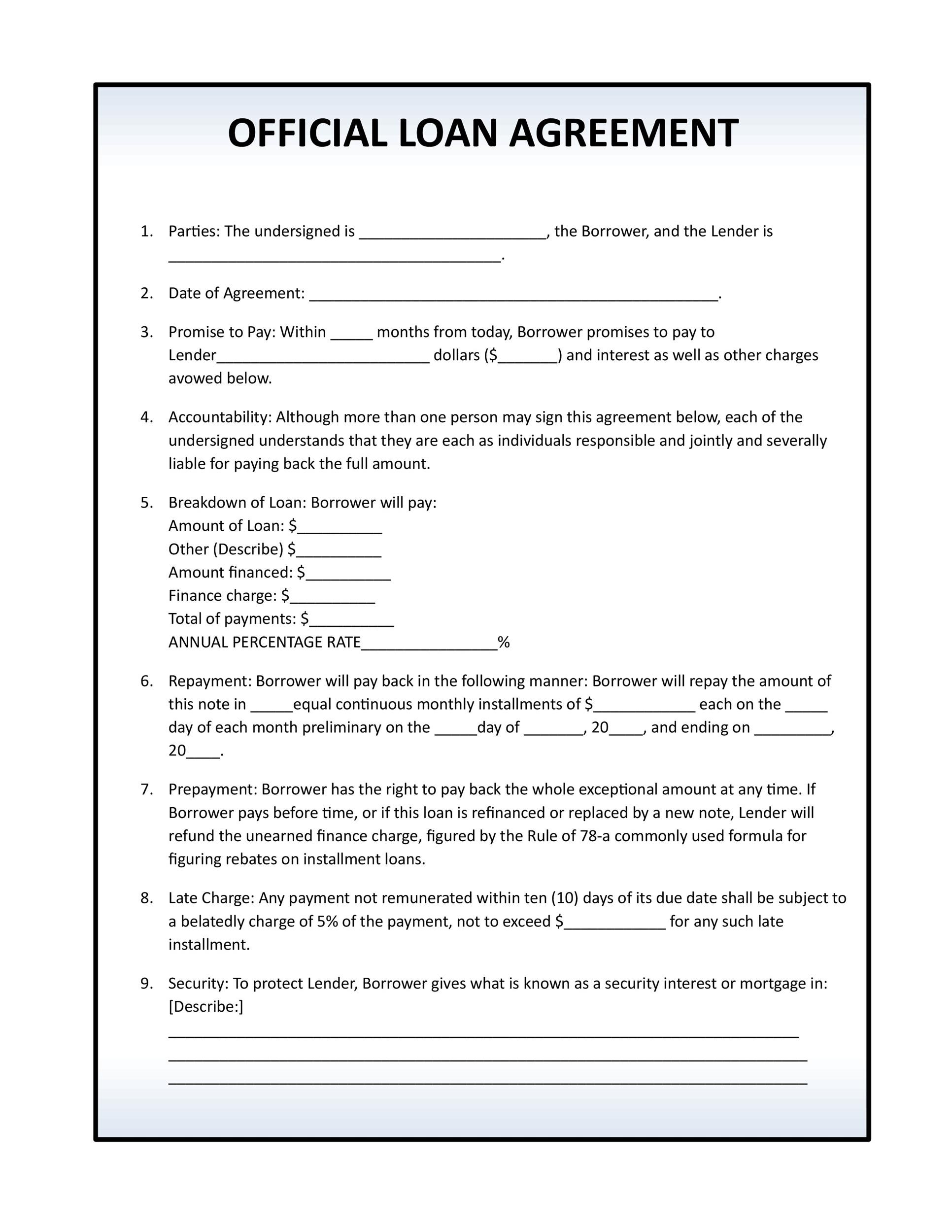

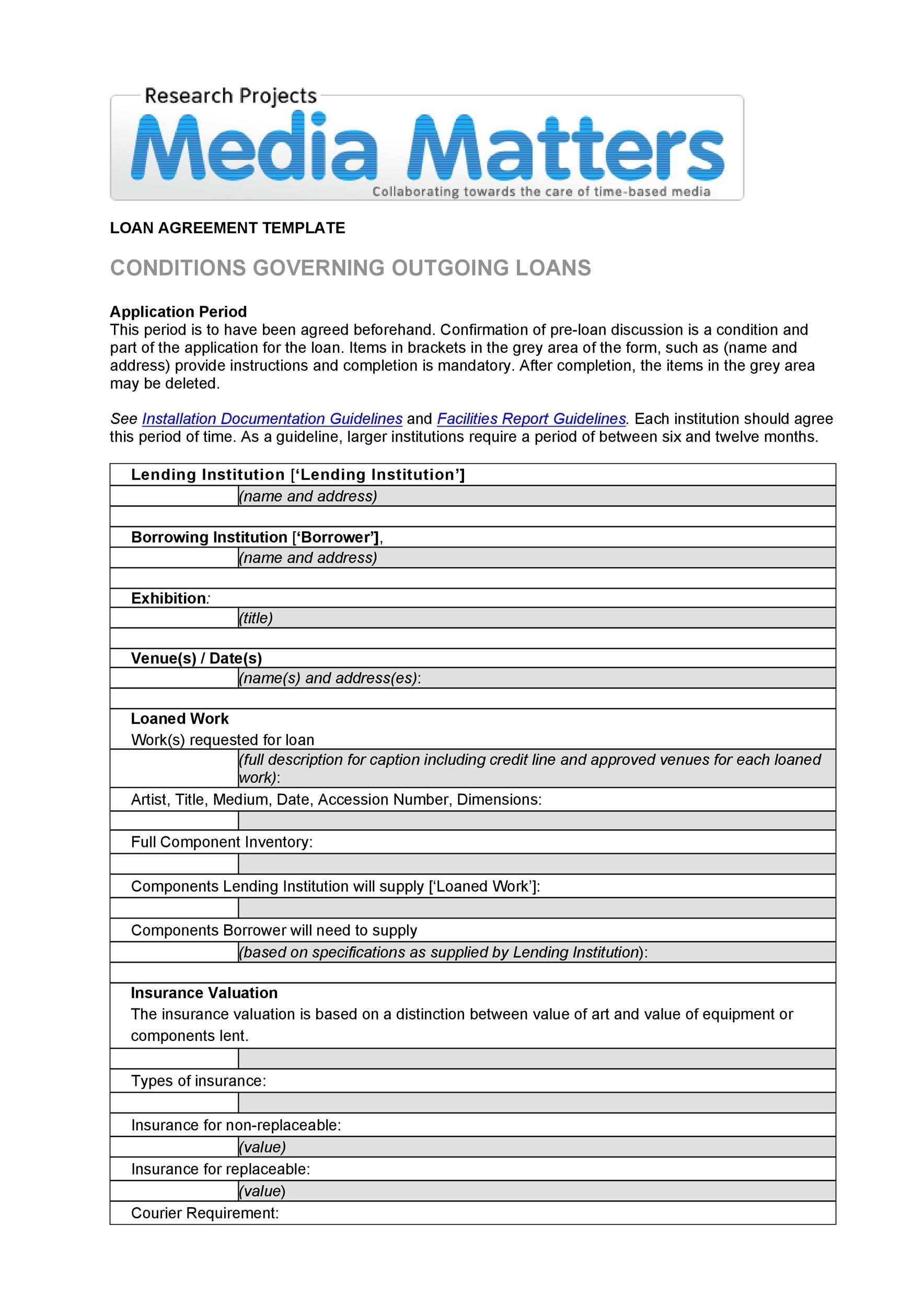

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

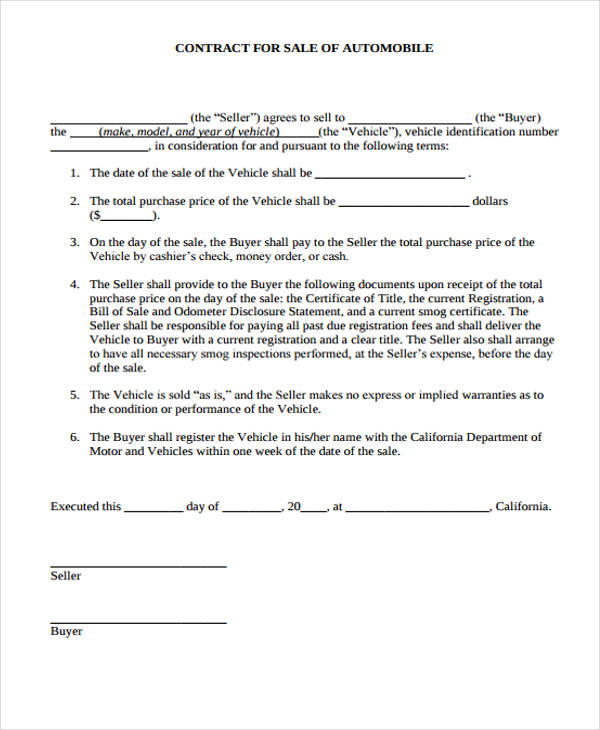

Printable Sample Loan Template Form Contract Template Student Loans Loan Application

Money Loan Contract Template Free Awesome 10 Best Of Money Payment Agreement Letter Contract Template Free Basic Templates Letter Template Word

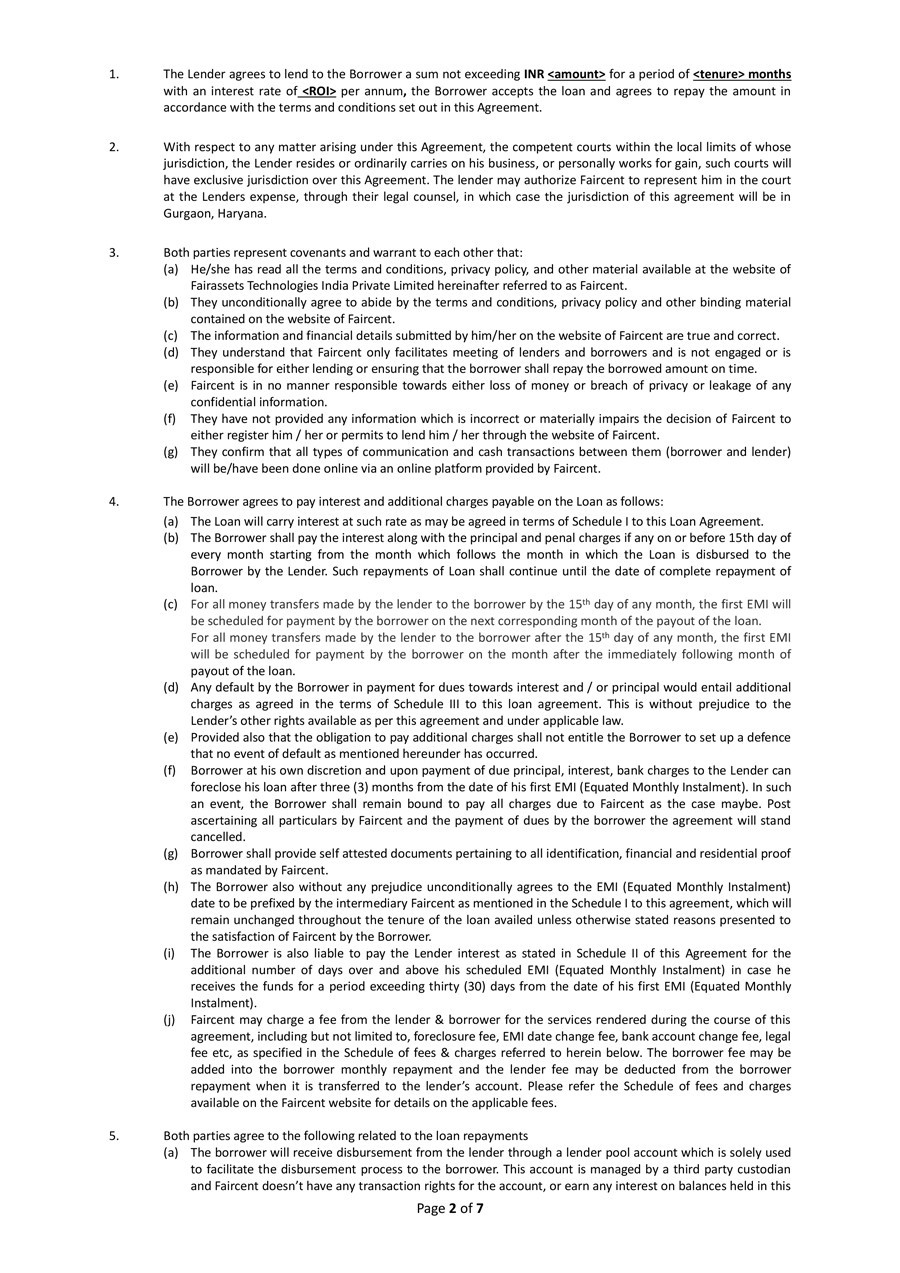

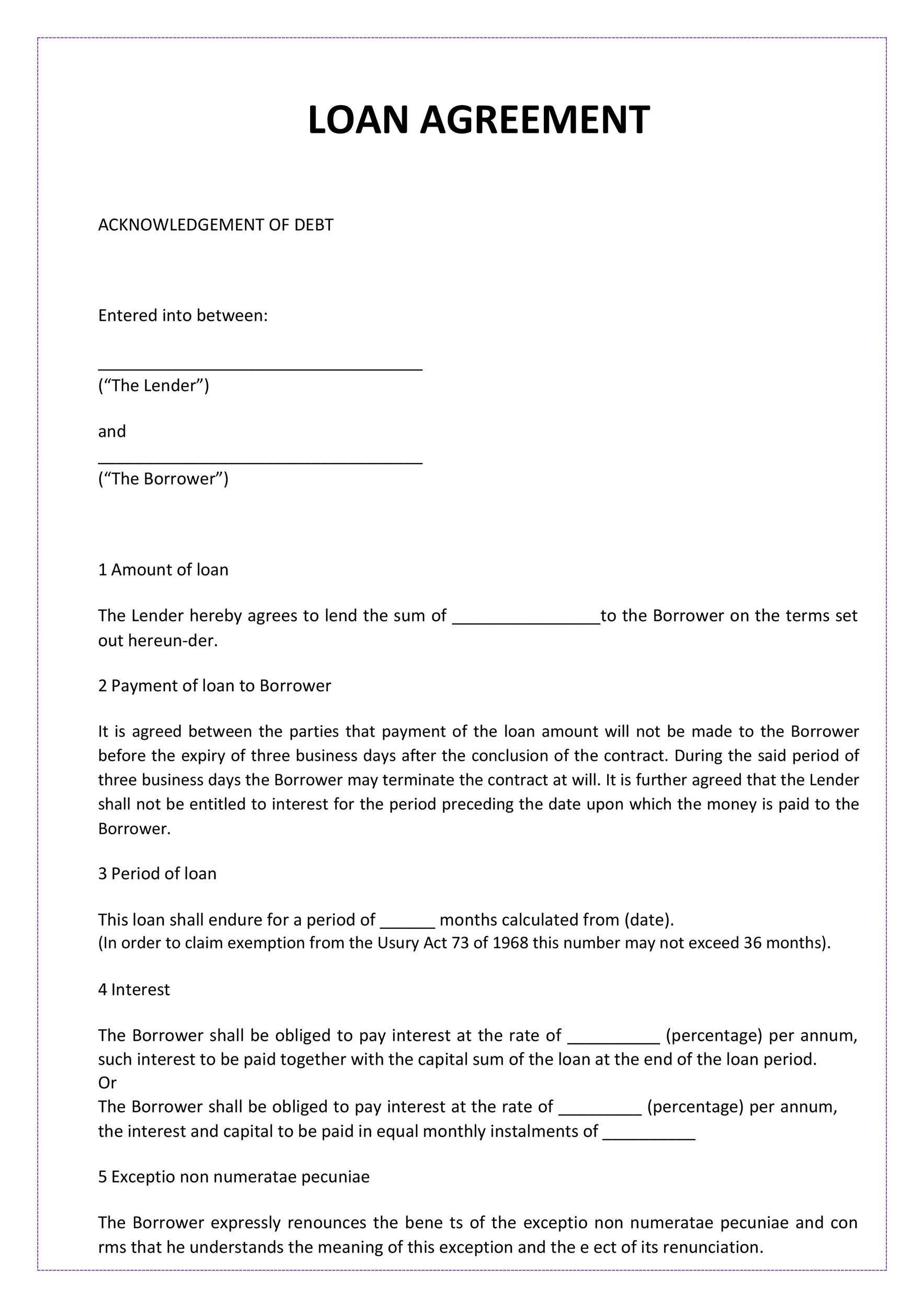

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Lending Money Contract Template Free Fresh Loan Agreement Letter Loan Contract And Agreement Contract Template Loan Lettering

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

40 Over 40 Inspirational Money Wins At Age 40 Money Stories How To Get Money Budgeting Money

Loan Form Template Best Of 40 Free Loan Agreement Templates Word Pdf Template Lab Contract Template Loan Collateral Loans

Personal Loan Contract Template Free Unique 40 Free Loan Agreement Templates Word Pdf Template Lab Contract Template Personal Loans Letter Templates

Lending Money Contract Template Free Fresh Loan Agreement Letter Loan Contract And Agreement Contract Template Loan Lettering

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

Mortgage Closing Paperwork Can Be Overwhelming Home Tips For Women

Are There Any Good Mortgage Loans That Require No Down Payment Quora